Those tiny fees you barely notice? They add up fast. From hidden service charges to ATM withdrawal penalties, seemingly small expenses can quietly sabotage your savings goals. This article dives into the world of invisible costs, helping readers spot the culprits, understand their impact, and build a budget that stays on track.

The Silent Drain: Common Hidden Fees

Most people think they know where their money goes—until they check their bank statement. Routine fees like ATM charges, overdraft penalties, foreign transaction fees, and monthly maintenance costs often slip under the radar. Even subscriptions you forgot you had can continue pulling money each month. These charges often feel too small to matter individually, but collectively they can create a significant financial leak.

Some of the most commonly overlooked fees include:

- Account inactivity fees

- Paper statement charges

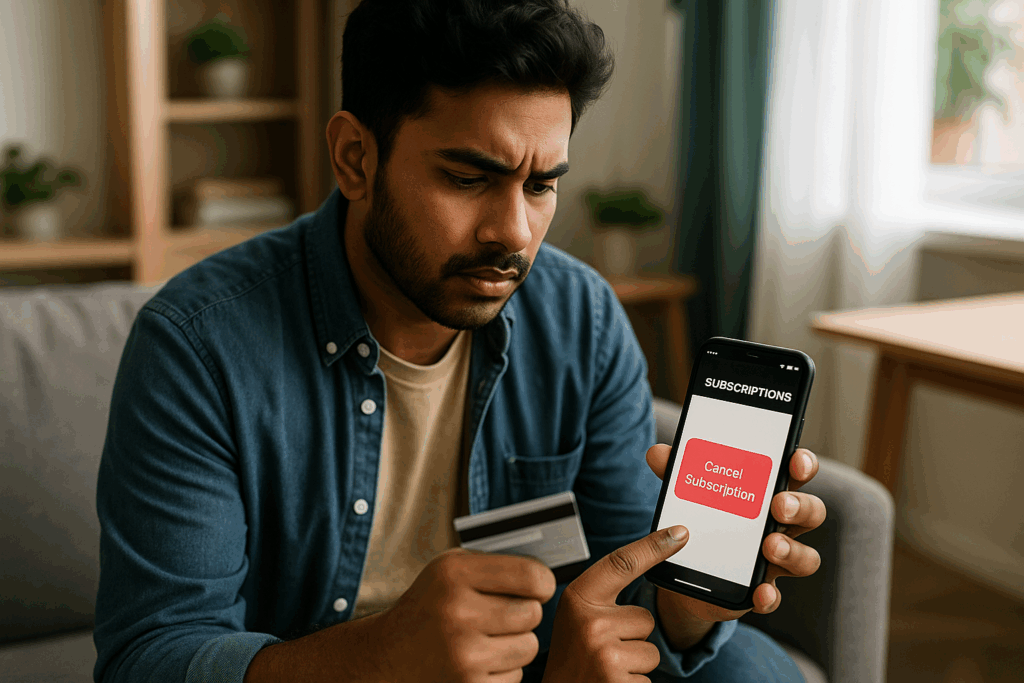

- Automatic subscription renewals

- Mobile banking service fees

These aren’t just rare or exotic fees—they’re often built into everyday financial tools and platforms.

Smarter Tracking Starts with Awareness

The first step to eliminating these charges is identifying them. That means reviewing your bank and credit card statements regularly—not just the balances, but the line-by-line details. Tools like budgeting apps (e.g., Mint, YNAB, or PocketGuard) can automatically track and categorize expenses, flagging repeat charges or sudden spikes.

Consider setting up account alerts to notify you of fees or unusual activity. Many banks allow you to receive emails or texts whenever a fee is applied, giving you the chance to dispute or avoid them in the future.

Take Control: Tools and Tactics to Save

Once you know where your money is going, you can take action. Start by calling your bank or service provider to request fee waivers or downgrade to a no-fee account. Cancel unused subscriptions and opt out of paper statements. If ATM fees are a recurring problem, switch to a bank with a larger ATM network or one that reimburses fees.

Creating a custom budget with a focus on recurring charges can also help. By building awareness into your monthly routine—such as a “budget check-in” every Sunday—you can catch new charges before they become regular drains.

Budgeting doesn’t have to be about sacrifice. Often, it’s about awareness. By spotting these sneaky charges early, you can redirect that lost money toward savings, debt payoff, or even something fun.