Spring is the perfect time to not only tidy up your living space but also your finances. A financial spring cleaning can help you shake off bad money habits, identify unnecessary expenses, and refocus your financial goals. Just like wiping down windows or organizing your closet, cleaning up your budget brings clarity and peace of mind.

Spotting Money Leaks

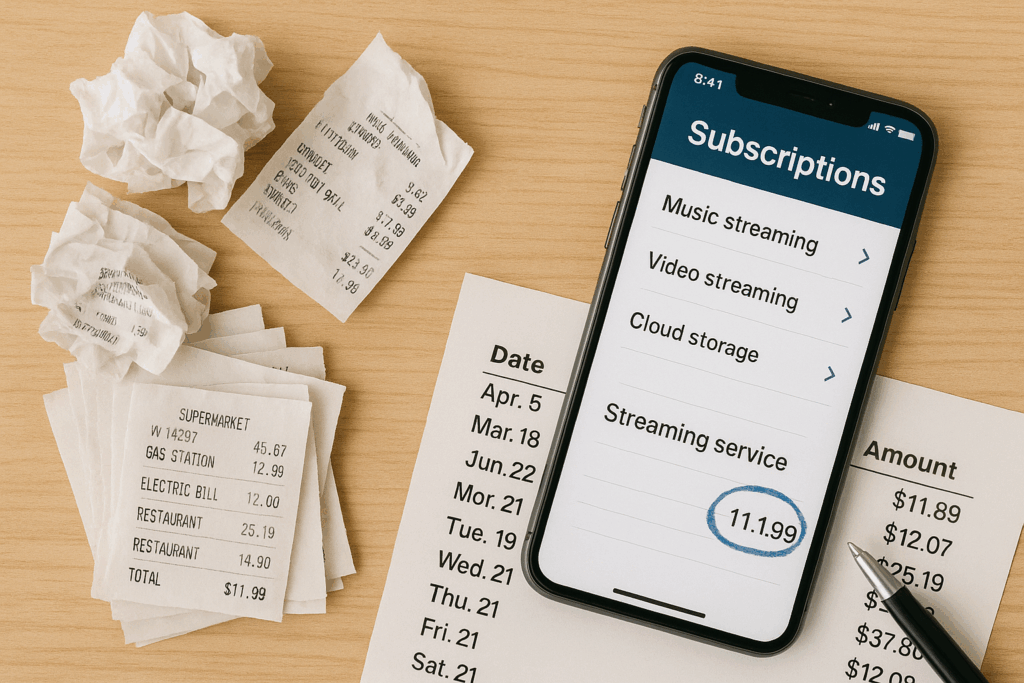

The first step in any financial refresh is identifying where your money is quietly slipping away. These “money leaks” might include unused subscriptions, excessive delivery fees, or impulse purchases. Review your bank and credit card statements for recurring charges you no longer use or need. Canceling even a few of these can free up funds you didn’t realize were being wasted.

Take it a step further by using an expense tracking app to monitor spending patterns. Categories like dining out, entertainment, and online shopping can quickly get out of control. Once you’ve spotted your leaks, you can start patching them—redirecting that money toward savings or debt repayment instead.

Reorganize Your Expenses

Once you’ve stopped the leaks, it’s time to organize. Create a clear, realistic monthly budget that reflects your current lifestyle and goals. Divide your expenses into fixed (like rent, utilities, insurance) and variable (like groceries, gas, entertainment). This separation makes it easier to adjust spending in categories you can control.

Consider using the 50/30/20 rule as a guideline: 50% of your income for needs, 30% for wants, and 20% for savings or debt. Automate your bill payments and savings transfers to avoid missed deadlines and ensure consistency. Think of this step like organizing your closet—you want everything in its place and easy to manage.

Refresh Your Financial Goals

Spring is also a great time to revisit your financial goals. Have your priorities changed since the start of the year? Maybe you’re now more focused on saving for a trip, paying off a specific debt, or building an emergency fund. Set SMART goals—Specific, Measurable, Achievable, Relevant, and Time-bound—and write them down.

Review your progress toward any long-term goals, such as retirement savings or a home purchase, and adjust your strategy if needed. A fresh set of financial intentions can reignite your motivation and give you direction for the months ahead.

Make It a Habit

The key to lasting success is consistency. Make financial check-ins a regular habit—monthly or quarterly—so your budget never gets out of hand again. Just as regular house cleaning keeps things in order, a standing financial routine prevents clutter from building up. With each check-in, adjust for changes in income, expenses, or goals so your financial plan always reflects your current reality.