It starts with a free trial or a $4.99 monthly fee that seems too small to notice. But over time, subscription services—from fitness apps to streaming platforms—can quietly pile up and chip away at your budget. Many people don’t realize how much they’re spending on recurring charges until they take a closer look. This article guides readers through a subscription audit and offers practical steps to regain financial control.

Spotting the Sneaky Charges

Many subscriptions are designed to be forgettable—auto-renewing silently in the background. Credit card statements may list company names that don’t clearly identify the service, making it easy to miss. And those free trials? If you don’t cancel in time, they become costly line items. Taking stock of all monthly and annual charges is the first step to recognizing what’s draining your finances.

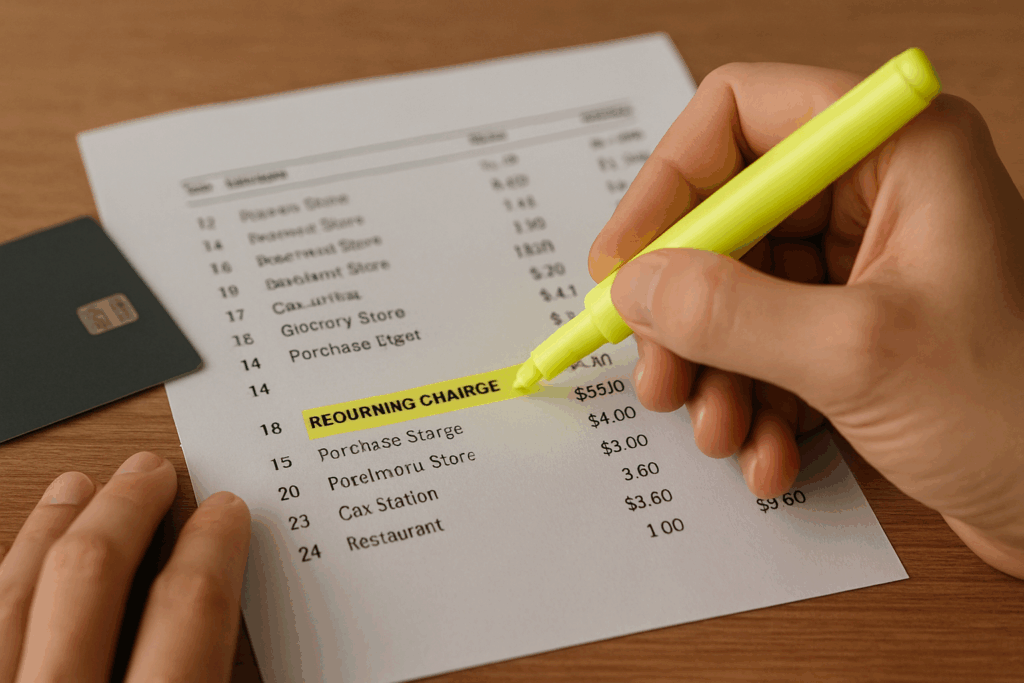

Start by scanning the past three months of bank and credit card statements. Highlight anything with words like “subscription,” “monthly,” “renewal,” or names of digital services. You might be surprised by what you find: overlapping streaming platforms, fitness apps you haven’t opened in months, or software tools you no longer use.

Audit Your Usage Honestly

Once you’ve identified all your subscriptions, it’s time for a reality check. Are you actually using what you’re paying for? Streaming platforms often lure people in with one show, only to sit idle once it ends. Gym memberships go untouched for months. Digital tools meant to boost productivity sometimes go unopened after the novelty wears off.

Ask yourself: How often do I use this service? Does it add real value to my daily life? If the answer is “rarely” or “not at all,” it’s a prime candidate for cancellation. Don’t fall for the sunk cost fallacy—the idea that just because you’ve paid for something, you should keep paying.

Cut Costs and Reclaim Control

Canceling unused subscriptions isn’t just about saving money—it’s about realigning spending with your values. That $30 a month spent on forgotten services could go toward debt repayment, investing, or something that genuinely brings you joy. Use budgeting tools or apps that categorize and alert you to recurring payments so you can stay vigilant moving forward.

And if you do find value in a subscription, consider whether a cheaper or bundled option exists. Some services offer annual plans that save money in the long run, or student/family pricing that lowers the cost per user. Be intentional: only keep what truly enhances your life.