Money Reads

Spend Smarter, One Tip at a Time!

Welcome to the Money Hub on My Digital Dive! From savvy saving strategies to budgeting hacks, smart spending tips, and ways to grow your financial know-how, we’ve got everything you need to make the most of your money. Whether you’re aiming to stretch your paycheck, crush your debt, or build toward long-term goals, dive into our latest articles and take control of your finances today!

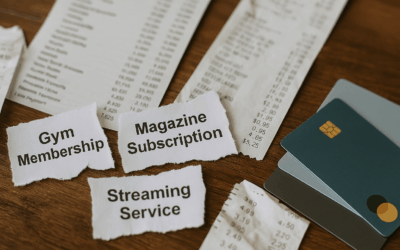

The Hidden Cost of Convenience: How Subscription Creep Eats Your Budget

It starts with a free trial or a $4.99 monthly deal. Before you know it, your bank statement is a scroll of streaming services, delivery apps, fitness platforms, and digital tools—all auto-renewing, all quietly draining your budget. Subscription creep has become a...

Financial Red Flags in Dating: What to Watch For Before Sharing a Budget

When love starts to get serious, money inevitably enters the picture. From splitting the dinner bill to co-signing leases or planning a future together, financial compatibility plays a crucial role in long-term relationship success. But while romance can be blind,...

The Grocery Game: Smart Shopping Strategies to Beat Inflation

Every trip to the grocery store seems to come with sticker shock these days. With inflation driving up the cost of everything from produce to pantry staples, consumers are feeling the pinch in their wallets. But saving money at the supermarket doesn’t require extreme...

Budget Killers: The Sneaky Charges Hiding in Your Bank Statement

Those tiny fees you barely notice? They add up fast. From hidden service charges to ATM withdrawal penalties, seemingly small expenses can quietly sabotage your savings goals. This article dives into the world of invisible costs, helping readers spot the culprits,...

The Side Hustle Trap: When Earning More Doesn’t Equal Saving More

As side hustles become more popular than ever, many workers expect that bringing in extra income will lead to stronger savings and financial freedom. But reality often paints a different picture. Despite the additional earnings, many find themselves still living...

How to Build a Budget You’ll Actually Stick To

Budgets often fail not because we can’t do math—but because they ignore how real people think, feel, and live. Emotional triggers, lifestyle pressures, and the occasional treat all play a role in how we spend. This article explores a more forgiving, human-centered way...

The Subscription Trap: Are You Wasting Money Each Month?

It starts with a free trial or a $4.99 monthly fee that seems too small to notice. But over time, subscription services—from fitness apps to streaming platforms—can quietly pile up and chip away at your budget. Many people don’t realize how much they’re spending on...

Financial Spring Cleaning: Declutter Your Budget and Start Fresh

Spring is the perfect time to not only tidy up your living space but also your finances. A financial spring cleaning can help you shake off bad money habits, identify unnecessary expenses, and refocus your financial goals. Just like wiping down windows or organizing...

Side Hustles You Can Start Today: Boost Your Income Without Quitting Your Job

Finding ways to supplement your income without giving up the security of a full-time job is more attainable than ever. Thanks to technology and a growing freelance economy, side hustles have become a popular way to explore passions, build new skills, and strengthen...

Join My Digital Dive – Stay in the Know!

Don’t miss out on the latest trending stories, life hacks, money-saving tips, fun games, and more! When you sign up for My Digital Dive, you’ll get a steady stream of quick, engaging, and valuable content delivered straight to you—no fluff, just the good stuff.